Saturday, October 18, 2025

Guatemala Cardamom Harvest 2025–2026

Monday, October 13, 2025

Pepper price today October 12

Ending the week near the peak of 150,000 VND/kg

Pepper price today October 12: Dak Lak, Lam Dong hit 148,000 VND/kg, export reached 1.26 billion USD. Price is stable, next week it may increase to 151,000 VND/kg!

Pepper price today in domestic market October 12, 2025

Vietnam's domestic pepper market on October 12, 2025, prices remained stable, Dak Lak and Lam Dong led. Vietnam's domestic pepper market in the trading session on October 12, 2025 continued to show signs of stability when most key provinces kept their purchasing prices unchanged compared to the previous day.

Dak Lak and Lam Dong are currently sharing the market leadership position with the highest price of 148,000 VND/kg. Both regions have kept prices stable (no change compared to October 11, 2025).

Gia Lai closed the session at 146,000 VND/kg, unchanged from the previous day.

Ho Chi Minh City recorded an average purchase price of VND 146,500/kg, no change.

Dong Nai maintains the price unchanged, stable at 146,000 VND/kg (no change compared to October 9, 2025).

According to statistics from the Vietnam Pepper and Spice Association (VPSA), Vietnam imported 1,588 tons of pepper of all kinds in September 2025, with a turnover of 10.4 million USD, black pepper reaching 1,431 tons, white pepper reaching 157 tons. Compared to August 2025, the imported pepper volume decreased by 48%, and the turnover decreased by 47.8%.

Despite a recent decrease, in the first 9 months of the year, Vietnam's pepper imports still increased sharply by 51.9% in volume and 121.1% in value compared to the same period in 2024, reaching 36,112 tons with a value of 225.7 million USD, of which black pepper reached 30,728 tons and white pepper reached 5,384 tons.

In terms of exports, Vietnam exported 20,487 tons of pepper of all kinds in September 2025, earning 136.3 million USD. In the first 9 months of the year, Vietnam exported 186,997 tons of pepper, down 6.9% in volume but up 27.6% in value, reaching more than 1.26 billion USD.

The upward trend in pepper prices in the international market and the recovery in demand in many major markets are favorable signals for exports in the last months of the year. Although export output has decreased slightly, the sharp increase in prices has helped the pepper industry achieve high turnover, opening up the possibility of ending 2025 with impressive growth in value.

In fact, many farmers have temporarily stopped selling in the hope that prices will increase in the last months of the year when global consumer demand recovers.

According to many experts and export enterprises, domestic pepper prices may continue to stabilize or increase slightly early next week, with a range of about 500 - 1,500 VND/kg. If new export orders are signed, especially from the US and Middle East markets, prices may increase to the range of 151,000 - 152,000 VND/kg in some localities.

World pepper price today October 12, 2025

The world pepper market in the trading session on October 12, 2025 recorded an absolutely stable trend in all commodities, without any changes or fluctuations compared to the previous trading session (shown through the empty Fluctuation column).

Malaysian pepper price is the most expensive item, maintaining the highest level in the statistics table:

Malaysian White Pepper ASTA price was stable at 1250 (unit value), still the highest price.

Kuching Black Pepper (Malaysia) ASTA price is stable, currently remaining at 950 (unit value).

Indonesian pepper prices also remained stable:

Lampung Black Pepper (Indonesia) price closed at 723 (unit value).

Muntok White Pepper (Indonesia) price remained at 1008.8 (unit value).

The Brazilian and Vietnamese markets today recorded complete stability across all categories, without any changes:

Brazilian Black Pepper ASTA 570 price is stable at 620 (unit value), continuing to be the lowest price in the statistics table.

Vietnamese black pepper (500 gr/l) reached 660 (unit value).

Vietnamese black pepper (550 gr/l) reached 680 (unit value).

Similarly, the price of Vietnamese White Pepper was stable, reaching 925 (unit value).

Pepper price forecast for next week

According to the Vietnam Pepper and Spices Association (VPSA), in the first 9 months of the year, Brazil exported 63,988 tons of pepper, reaching a turnover of 396.8 million USD, a sharp increase compared to the same period in 2024 and 2023. The average export price reached 6,201 USD/ton, an increase of more than 48% over the previous year. Vietnam is still the largest market, importing more than 19,350 tons, accounting for 30.2% of the market share.

According to businesses, pepper prices are trading at high levels thanks to a decline in global supply and strong demand from major markets such as the US, India and the Middle East. Vietnam remains the world’s number one pepper supplier.

Source: https://baodanang.vn/gia-tieu-hom-nay-12-10-chot-tuan-o-sat-dinh-150-000-dong-kg-3306068.html

Saturday, October 11, 2025

Wednesday, October 08, 2025

Pepper price today October 8

Increased across the board, 2 provinces reached peak of 148,000 VND/kg

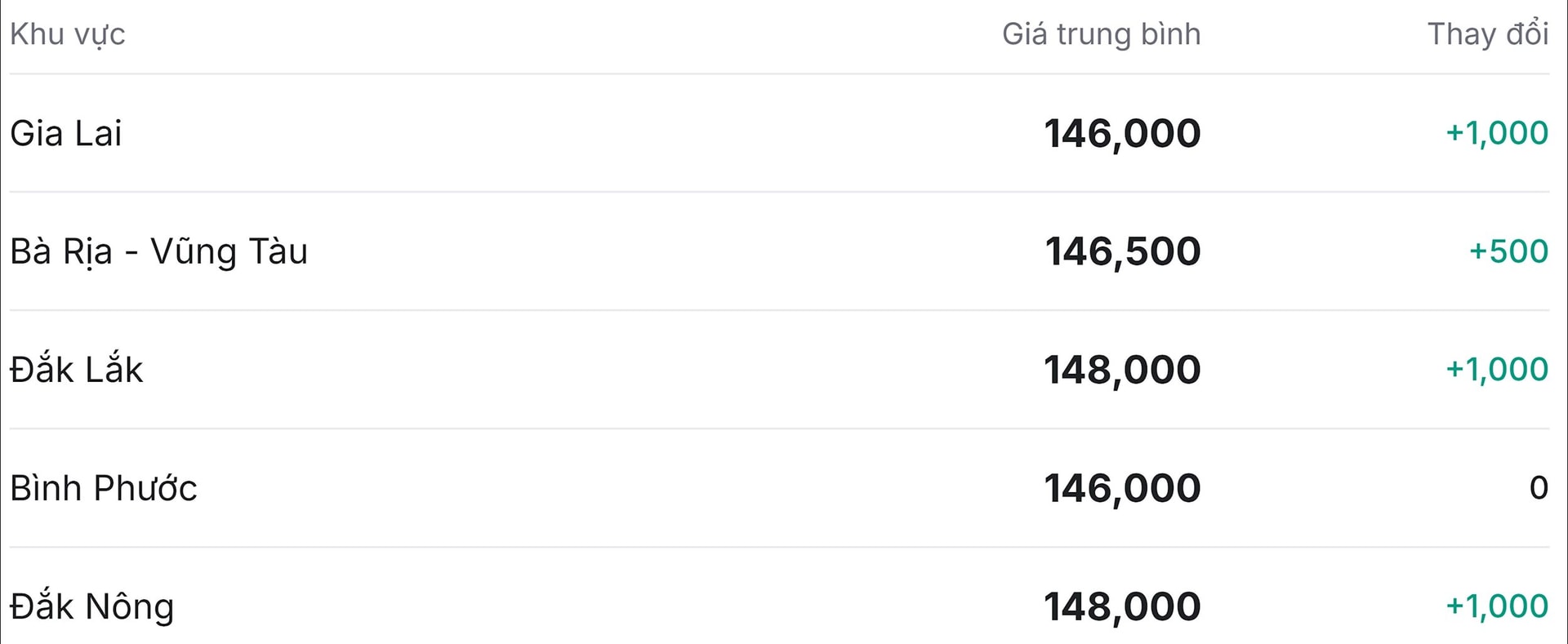

Pepper prices today, October 8, 2025, increased across the board, with Dak Lak and Dak Nong reaching a peak of 148,000 VND/kg. The world remained stable, with Indonesia increasing slightly by 0.22-0.23 USD/ton.

Báo Đà Nẵng•08/10/2025

Báo Đà Nẵng•08/10/2025Pepper price today in domestic market October 8, 2025

The domestic pepper market in Vietnam in today's trading session continued to show a positive signal when most key provinces increased prices, only Binh Phuoc maintained a stable level.

The Central Highlands provinces continue to be the focus of price increases, with three major provinces simultaneously recording an increase of VND 1,000/kg:

Dak Lak and Dak Nong are currently sharing the market leadership position with the highest price of 148,000 VND/kg. Both regions have significantly increased compared to the previous day.

Gia Lai is also not out of the growth trend, closing the session at 146,000 VND/kg after increasing by 1,000 VND/kg.

Price developments in the Southeast region have clear differentiation:

Ba Ria - Vung Tau recorded a slight increase, specifically 500 VND/kg, bringing the average purchase price to 146,500 VND/kg.

Binh Phuoc is the only region in the statistics that kept the price unchanged, stable at 146,000 VND/kg.

In general, pepper purchase prices in major production areas are currently fluctuating within the range of 146,000 to 148,000 VND/kg. The general trend is slight and even growth, showing optimistic sentiment in the market.

World pepper price today October 8, 2025

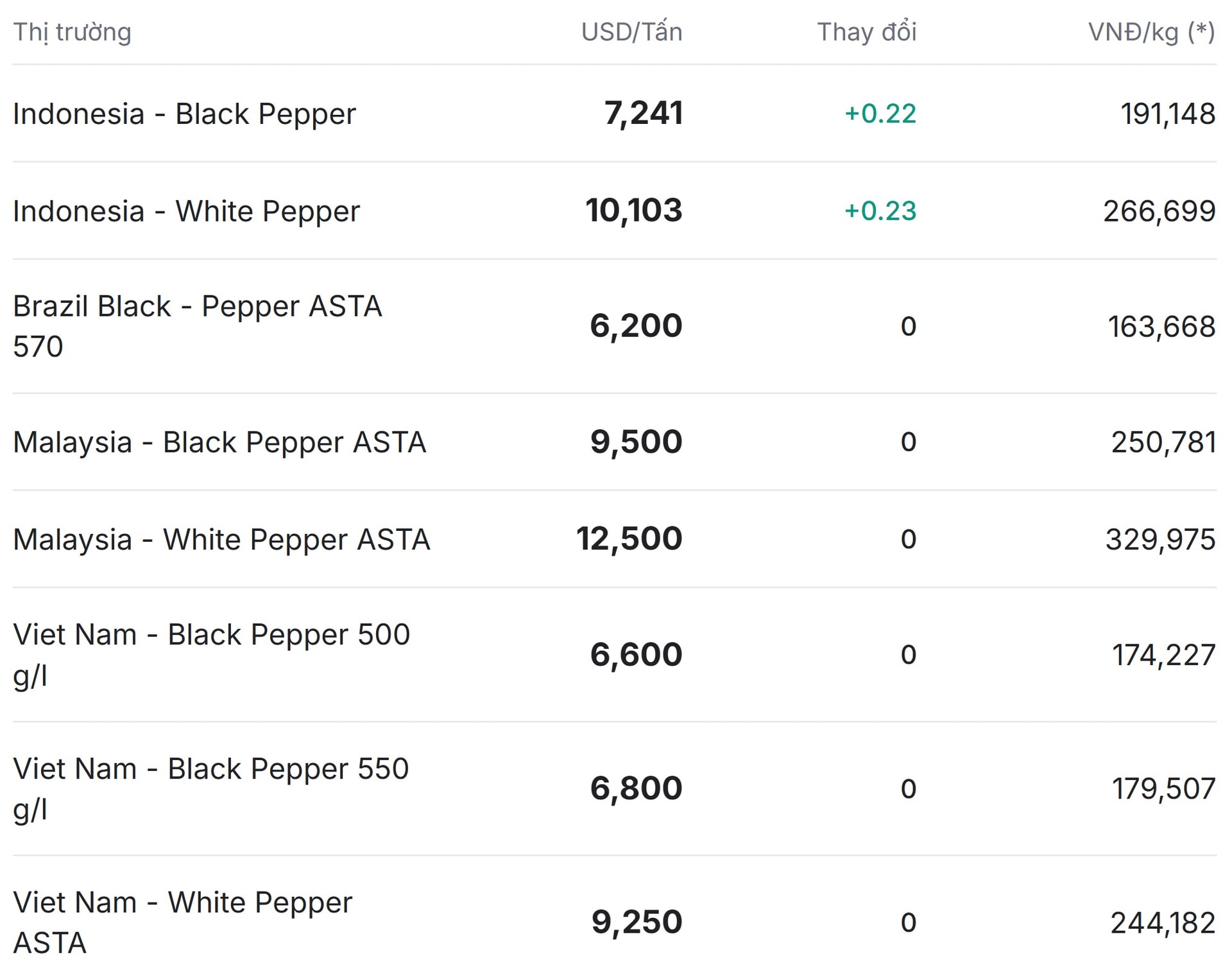

The world pepper market in today's trading session recorded a slight upward trend in some segments of Indonesia, while pepper prices of other major producing countries such as Vietnam, Brazil, and Malaysia remained stable, with no significant changes compared to the previous trading session.

Indonesian pepper prices are the only market with price adjustments today, with a very slight increase:

Indonesian Black Pepper price increased by +0.22 USD/ton, closing at 7,241 USD/ton (equivalent to 191,148 VND/kg).

White Pepper price is currently held at 10,103 USD/ton, recording a slight increase of +0.23 USD/ton (equivalent to 266,699 VND/kg).

The Brazilian and Malaysian markets today recorded complete stability across all categories, with no changes:

The price of Brazilian ASTA 570 Black Pepper was stable at 6,200 USD/ton (equivalent to 163,668 VND/kg), continuing to be the lowest price in the statistics table.

The price of Malaysian ASTA Black Pepper is stable, currently remaining at 9,500 USD/ton (equivalent to 250,781 VND/kg).

Malaysian ASTA White Pepper price was stable at USD 12,500/ton (equivalent to VND 329,975/kg), still the highest price in the table.

Vietnam's pepper prices of all types are stable compared to yesterday, with no fluctuations recorded in any segment:

Black pepper 500 g/l reached 6,600 USD/ton (equivalent to 174,227 VND/kg).

Black pepper 550 g/l reached 6,800 USD/ton (equivalent to 179,507 VND/kg).

Similarly, Vietnam's ASTA White Pepper price remained stable compared to yesterday, reaching 9,250 USD/ton (equivalent to 244,182 VND/kg).

Vietnam's pepper exports in September 2025 grew strongly, export prices remained stable

According to the Vietnam Pepper and Spices Association (VPSA), in September 2025, Vietnam exported 20,487 tons of pepper, earning 136.3 million USD. Although the export volume decreased slightly compared to August, both the output and export value recorded a significant increase compared to the same period in 2024, up 19.5% and 23.2%, respectively. The average export price of black pepper reached 6,490 USD/ton, up 2.4%, while white pepper had an average price of 8,679 USD/ton, up 1.4%.

Leading pepper exporters include Olam, Phuc Sinh and Nedspice, with Olam reaching nearly 2,000 tonnes. The US continues to be the largest import market with 4,274 tonnes, followed by China, the UAE, the Netherlands, Thailand and Germany. In contrast, Vietnam imported 1,588 tonnes of pepper in September, mainly from countries such as Cambodia, Brazil and Indonesia.

Experts say that in the short term, pepper prices are unlikely to increase sharply as speculative capital is temporarily shifting to coffee as the new harvest season begins. However, with stable import demand from major markets and export volume increasing compared to the same period last year, the outlook for Vietnam's pepper prices in the final months of the year is still considered positive.

Source: https://baodanang.vn/gia-tieu-hom-nay-8-10-tang-dong-loat-2-tinh-cham-dinh-148-000-dong-kg-3305740.html

Monday, October 06, 2025

Pimento

Crop Update – September 2025

By mid-September 2025, we travelled to the key pimento producing regions to

assess recent developments regarding the new harvests.

Pimento

Crop Update – September 2025

By mid-September 2025, we travelled to the key pimento producing regions to

assess recent developments regarding the new harvests.

Honduras

Our journey began in Honduras, where the crop size was normal, totalling

approximately 1,000 metric tons. Honduran exporters began offering in July, and

prices have gradually increased since then.

The pimento here is sun-dried, which takes more time to prepare and ship. As a

result, not all contracts have been shipped yet. Meanwhile, nearly all free

available stock has been sold.

Guatemala

Shortly after Honduras, Guatemala also began offering pimento. Their total crop

size is expected to be similar to that of Honduras this season. It’s important

to note that most Guatemalan pimento is machine-dried using wood-fired heat.

Only a small portion is sun-dried or dried using gas (indirect heating).

Wood-dried pimento is not suitable for the European market due to elevated

levels of anthraquinone and PAHs, which exceed EU-legislation. Consequently,

most Guatemalan pimento is sold to alternative markets such as the Middle East,

North Africa, and Russia. Following the trend in Honduras, prices in Guatemala

have also risen over the past month. Currently, only machine-dried pimento is

available, held by larger local traders and collectors. These traders, having

profited from the cardamom trade, are financially strong and not in a rush to

sell.

Mexico

Finally, we visited Mexico to assess the situation on the ground.

Initially, expectations were high for another strong crop. Last year, over

10,000 metric tons were exported, and a similar volume was anticipated this

season. Exporters had already begun preparing infrastructure to handle this

volume. However, despite promising early blooming, adverse weather in May and

June severely impacted production. Heavy rains destroyed flowers and young

pimento berries, drastically reducing the crop.

In just a few weeks, the outlook changed, and the harvest is now expected to be

40–60% lower than last year. In some areas, losses exceed 80% (!). Estimates

vary, with some suggesting only 2,500 metric tons will be produced in total,

while others are somewhat more optimistic. Based on multiple conversations, it

is estimated that this year’s output is around 5,000 metric tons, with a

possible carry-over of around 1,000 metric tons from last season. As seen in

recent years, farmers, collectors, and local traders now have greater financial

resources and are able to hold onto stock until prices meet their expectations

or they need quick cash. Currently, around 2,000 Currently, around 2,000

metric tons is yet available with collectors and local traders, of which only

30% can still be sun-dried. The remainder has already been machine-dried.

Jamaica

As in previous seasons, Jamaica is once again facing severe drought and will

therefore hardly produce any pimento for export. Their already limited

production is not even sufficient to meet domestic consumption. In fact Jamaica

has even had to import pimento from other producing countries in order to cover

its own requirements.

Market Outlook

This sudden development has created

significant uncertainty in the market, as many buyers have limited coverage.

While buyers were hoping for lower prices, most exporters in origin delayed

their offers until they had a clearer picture and first tried to secure raw

materials themselves. This has led to a nervous and precarious market

situation. Initial offers are now being presented, but prices are higher than

last year, making buyers hesitant. However, given the outlook for the rest of

the season, we recommend securing your annual requirements as soon as possible.

Last year, the market absorbed over 13,000 metric tons of pimento from all

origins. If this season only yields to around 8,000 metric tons in total, we

should prepare for a bullish and challenging pimento season.

Catz International B.V. tropical@catz.nl

--

WHATSAPP:

+5511988027709

SKYPE: mmddww1

FOR MARKET UPDATES & NEWS VISIT PEPPERTRADE SPICES BOARD BLOG

Honduras

Our journey began in Honduras, where the crop size was normal, totalling

approximately 1,000 metric tons. Honduran exporters began offering in July, and

prices have gradually increased since then.

The pimento here is sun-dried, which takes more time to prepare and ship. As a

result, not all contracts have been shipped yet. Meanwhile, nearly all free

available stock has been sold.

Guatemala

Shortly after Honduras, Guatemala also began offering pimento. Their total crop

size is expected to be similar to that of Honduras this season. It’s important

to note that most Guatemalan pimento is machine-dried using wood-fired heat.

Only a small portion is sun-dried or dried using gas (indirect heating).

Wood-dried pimento is not suitable for the European market due to elevated

levels of anthraquinone and PAHs, which exceed EU-legislation. Consequently,

most Guatemalan pimento is sold to alternative markets such as the Middle East,

North Africa, and Russia. Following the trend in Honduras, prices in Guatemala

have also risen over the past month. Currently, only machine-dried pimento is

available, held by larger local traders and collectors. These traders, having

profited from the cardamom trade, are financially strong and not in a rush to

sell.

Mexico

Finally, we visited Mexico to assess the situation on the ground.

Initially, expectations were high for another strong crop. Last year, over

10,000 metric tons were exported, and a similar volume was anticipated this

season. Exporters had already begun preparing infrastructure to handle this

volume. However, despite promising early blooming, adverse weather in May and

June severely impacted production. Heavy rains destroyed flowers and young

pimento berries, drastically reducing the crop.

In just a few weeks, the outlook changed, and the harvest is now expected to be

40–60% lower than last year. In some areas, losses exceed 80% (!). Estimates

vary, with some suggesting only 2,500 metric tons will be produced in total,

while others are somewhat more optimistic. Based on multiple conversations, it

is estimated that this year’s output is around 5,000 metric tons, with a

possible carry-over of around 1,000 metric tons from last season. As seen in

recent years, farmers, collectors, and local traders now have greater financial

resources and are able to hold onto stock until prices meet their expectations

or they need quick cash. Currently, around 2,000 Currently, around 2,000

metric tons is yet available with collectors and local traders, of which only

30% can still be sun-dried. The remainder has already been machine-dried.

Jamaica

As in previous seasons, Jamaica is once again facing severe drought and will

therefore hardly produce any pimento for export. Their already limited

production is not even sufficient to meet domestic consumption. In fact Jamaica

has even had to import pimento from other producing countries in order to cover

its own requirements.

Market Outlook

This sudden development has created

significant uncertainty in the market, as many buyers have limited coverage.

While buyers were hoping for lower prices, most exporters in origin delayed

their offers until they had a clearer picture and first tried to secure raw

materials themselves. This has led to a nervous and precarious market

situation. Initial offers are now being presented, but prices are higher than

last year, making buyers hesitant. However, given the outlook for the rest of

the season, we recommend securing your annual requirements as soon as possible.

Last year, the market absorbed over 13,000 metric tons of pimento from all

origins. If this season only yields to around 8,000 metric tons in total, we

should prepare for a bullish and challenging pimento season.

Catz International B.V. tropical@catz.nl

--

WHATSAPP:

+5511988027709

SKYPE: mmddww1

FOR MARKET UPDATES & NEWS VISIT PEPPERTRADE SPICES BOARD BLOG