Increased across the board, 2 provinces reached peak of 148,000 VND/kg

Pepper prices today, October 8, 2025, increased across the board, with Dak Lak and Dak Nong reaching a peak of 148,000 VND/kg. The world remained stable, with Indonesia increasing slightly by 0.22-0.23 USD/ton.

Báo Đà Nẵng•08/10/2025

Báo Đà Nẵng•08/10/2025Pepper price today in domestic market October 8, 2025

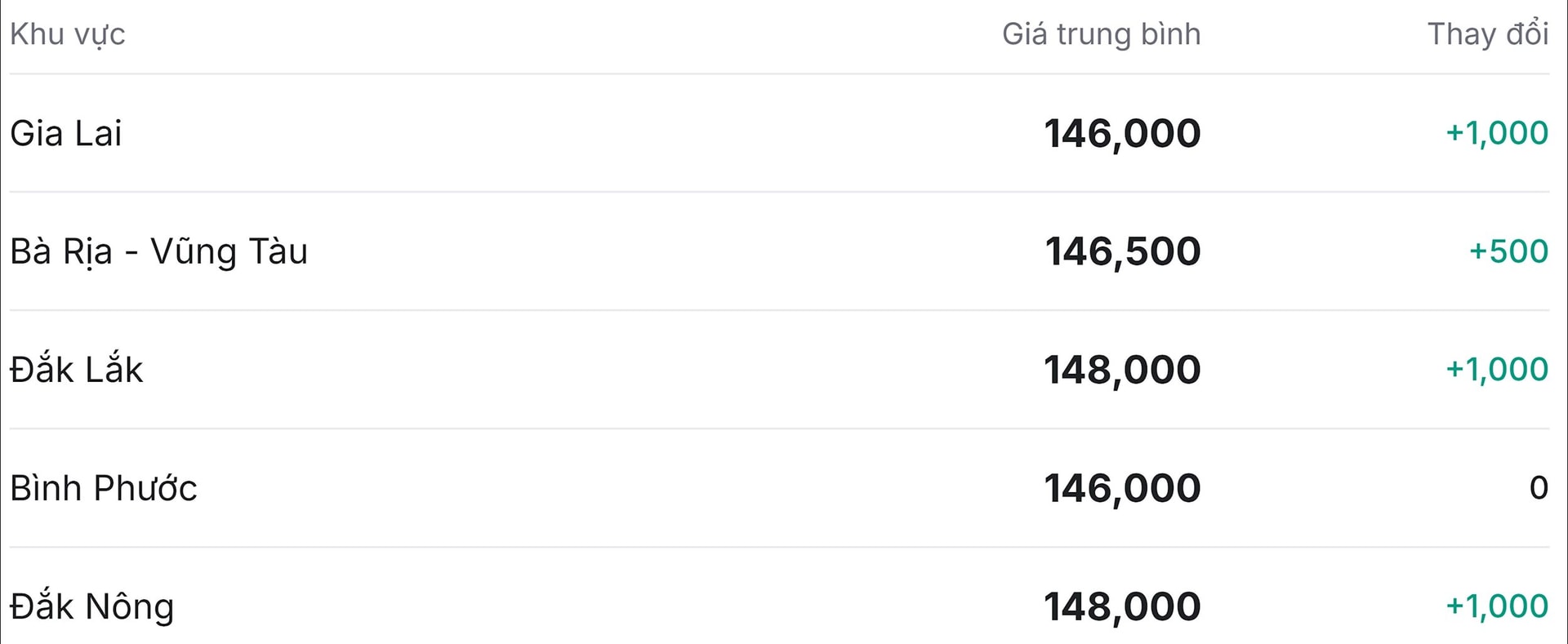

The domestic pepper market in Vietnam in today's trading session continued to show a positive signal when most key provinces increased prices, only Binh Phuoc maintained a stable level.

The Central Highlands provinces continue to be the focus of price increases, with three major provinces simultaneously recording an increase of VND 1,000/kg:

Dak Lak and Dak Nong are currently sharing the market leadership position with the highest price of 148,000 VND/kg. Both regions have significantly increased compared to the previous day.

Gia Lai is also not out of the growth trend, closing the session at 146,000 VND/kg after increasing by 1,000 VND/kg.

Price developments in the Southeast region have clear differentiation:

Ba Ria - Vung Tau recorded a slight increase, specifically 500 VND/kg, bringing the average purchase price to 146,500 VND/kg.

Binh Phuoc is the only region in the statistics that kept the price unchanged, stable at 146,000 VND/kg.

In general, pepper purchase prices in major production areas are currently fluctuating within the range of 146,000 to 148,000 VND/kg. The general trend is slight and even growth, showing optimistic sentiment in the market.

World pepper price today October 8, 2025

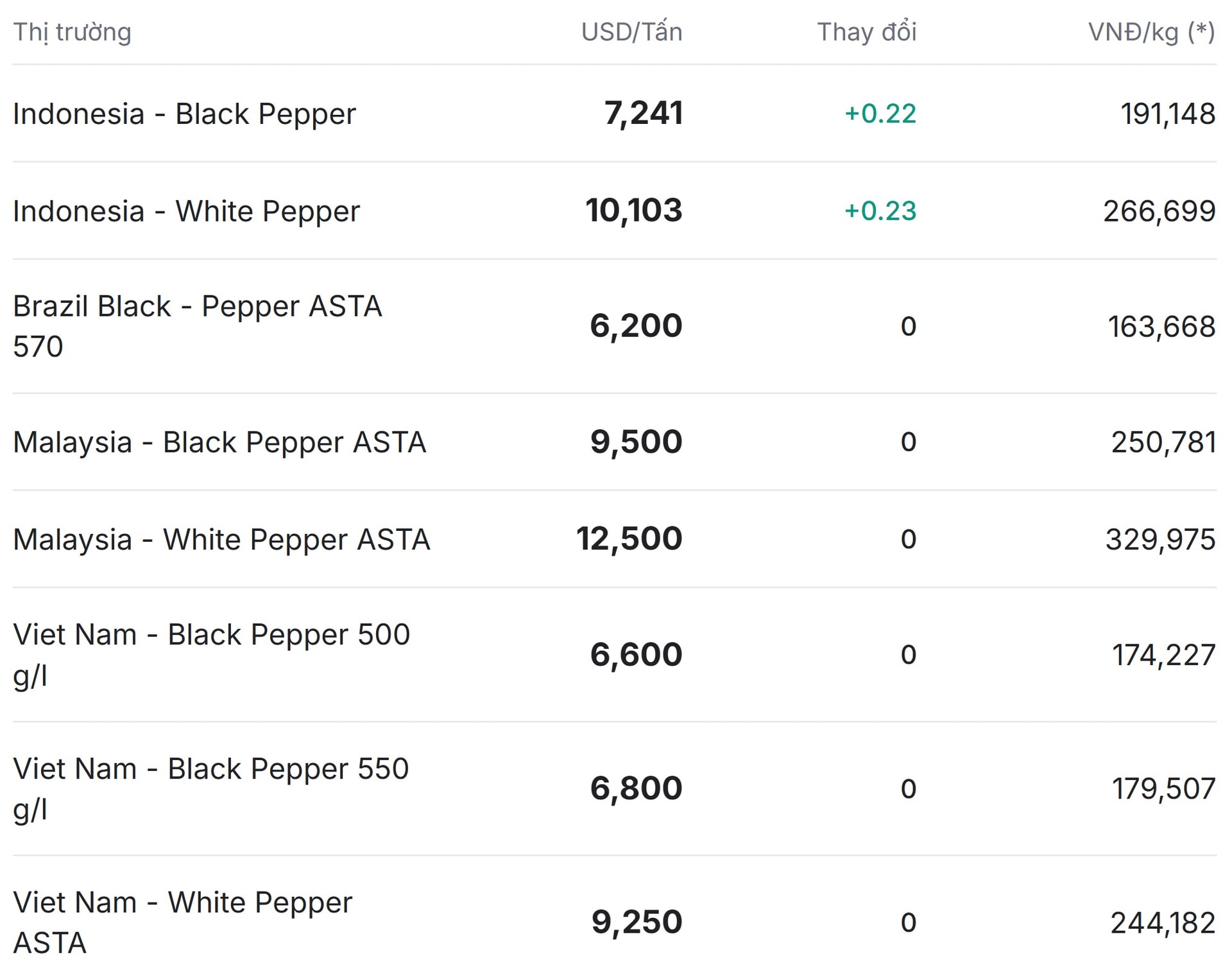

The world pepper market in today's trading session recorded a slight upward trend in some segments of Indonesia, while pepper prices of other major producing countries such as Vietnam, Brazil, and Malaysia remained stable, with no significant changes compared to the previous trading session.

Indonesian pepper prices are the only market with price adjustments today, with a very slight increase:

Indonesian Black Pepper price increased by +0.22 USD/ton, closing at 7,241 USD/ton (equivalent to 191,148 VND/kg).

White Pepper price is currently held at 10,103 USD/ton, recording a slight increase of +0.23 USD/ton (equivalent to 266,699 VND/kg).

The Brazilian and Malaysian markets today recorded complete stability across all categories, with no changes:

The price of Brazilian ASTA 570 Black Pepper was stable at 6,200 USD/ton (equivalent to 163,668 VND/kg), continuing to be the lowest price in the statistics table.

The price of Malaysian ASTA Black Pepper is stable, currently remaining at 9,500 USD/ton (equivalent to 250,781 VND/kg).

Malaysian ASTA White Pepper price was stable at USD 12,500/ton (equivalent to VND 329,975/kg), still the highest price in the table.

Vietnam's pepper prices of all types are stable compared to yesterday, with no fluctuations recorded in any segment:

Black pepper 500 g/l reached 6,600 USD/ton (equivalent to 174,227 VND/kg).

Black pepper 550 g/l reached 6,800 USD/ton (equivalent to 179,507 VND/kg).

Similarly, Vietnam's ASTA White Pepper price remained stable compared to yesterday, reaching 9,250 USD/ton (equivalent to 244,182 VND/kg).

Vietnam's pepper exports in September 2025 grew strongly, export prices remained stable

According to the Vietnam Pepper and Spices Association (VPSA), in September 2025, Vietnam exported 20,487 tons of pepper, earning 136.3 million USD. Although the export volume decreased slightly compared to August, both the output and export value recorded a significant increase compared to the same period in 2024, up 19.5% and 23.2%, respectively. The average export price of black pepper reached 6,490 USD/ton, up 2.4%, while white pepper had an average price of 8,679 USD/ton, up 1.4%.

Leading pepper exporters include Olam, Phuc Sinh and Nedspice, with Olam reaching nearly 2,000 tonnes. The US continues to be the largest import market with 4,274 tonnes, followed by China, the UAE, the Netherlands, Thailand and Germany. In contrast, Vietnam imported 1,588 tonnes of pepper in September, mainly from countries such as Cambodia, Brazil and Indonesia.

Experts say that in the short term, pepper prices are unlikely to increase sharply as speculative capital is temporarily shifting to coffee as the new harvest season begins. However, with stable import demand from major markets and export volume increasing compared to the same period last year, the outlook for Vietnam's pepper prices in the final months of the year is still considered positive.

Source: https://baodanang.vn/gia-tieu-hom-nay-8-10-tang-dong-loat-2-tinh-cham-dinh-148-000-dong-kg-3305740.html