Pepper price today November 27, 2025: Sharp increase of 2,000 VND

Today's domestic pepper price, November 27, 2025, increased by 2,000 VND, trading around 149,500 - 150,000 VND/kg. Meanwhile, world pepper prices remained stable.

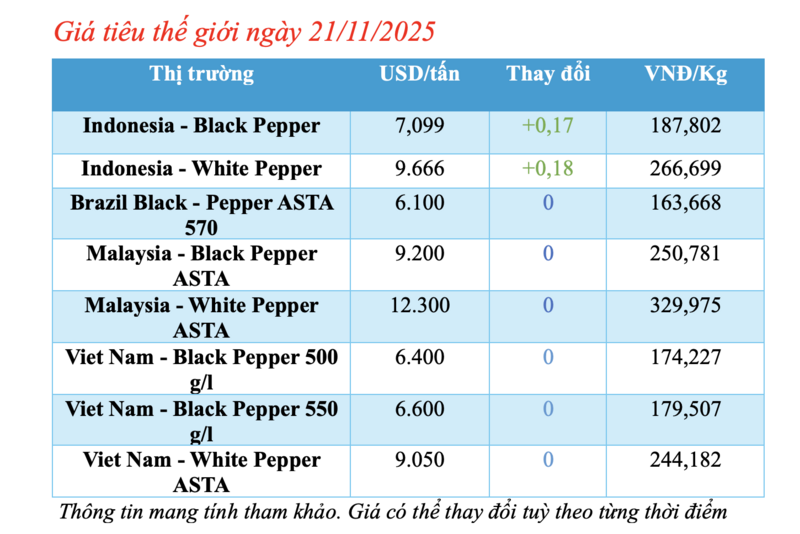

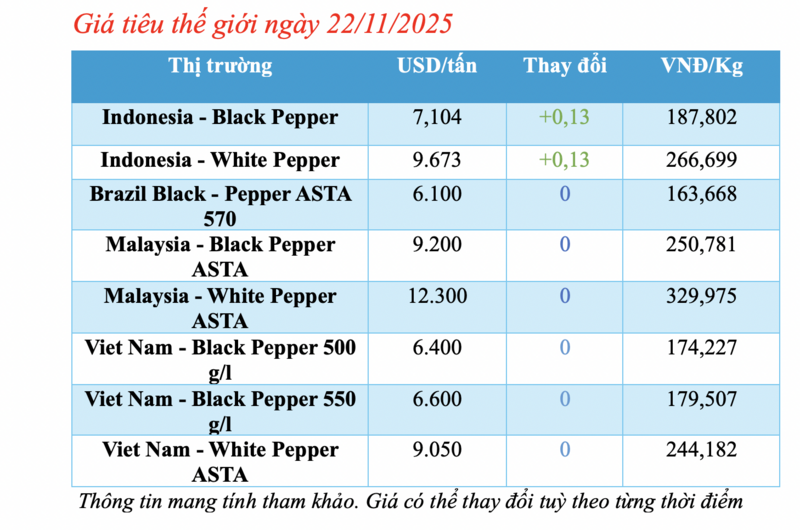

Pepper price today November 27th in the world latest

In the world, the latest pepper price on November 27 remained stable.

Accordingly, the price of Lampung black pepper in Indonesia remains at 7,126 USD/ton. The price of Muntok white pepper is anchored at 9,703 USD/ton.

The price of Malaysia's Kuching ASTA black pepper is currently at $9,200 per ton; while the country's ASTA white pepper is priced at $12,300 per ton.

For the Brazilian market, the price of ASTA 570 black pepper is trading at 6,175 USD/ton.

In Vietnam, the price of 500g/l black pepper is trading at 6,400 USD/ton, 550g/l is at 6,600 USD/ton; and the price of white pepper is at 9,050 USD/ton.

| Nation | Pepper type | Price (USD/ton) | Fluctuations |

| Indonesia | Lampung Black Pepper | 7,126 | - |

| Muntok White Pepper | 9,703 | - | |

| Brazil | Black Pepper ASTA 570 | 6,175 | - |

| Malaysia | Kuching Black Pepper ASTA | 9,200 | - |

| ASTA White Pepper | 12,300 | - | |

| Vietnam | Black pepper 500 g/l | 6,400 | - |

| Black pepper 550 g/l | 6,600 | - | |

| White pepper | 9,050 | - |

Latest world pepper price list today, November 27. Compiled by: Bang Nghiem

Thus, the world pepper price today, November 27, 2025, is unchanged compared to yesterday.

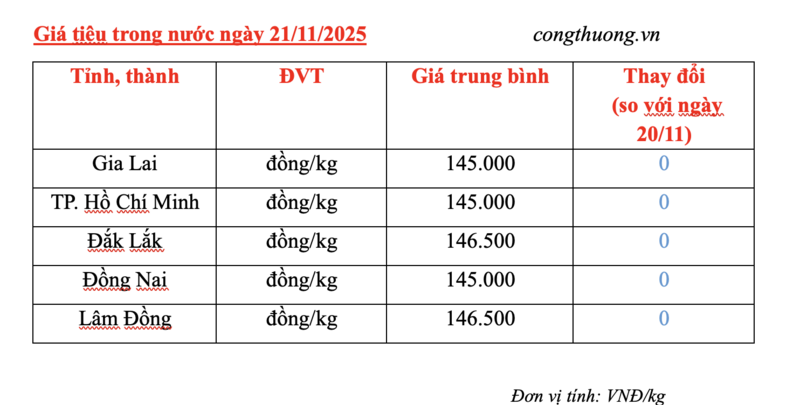

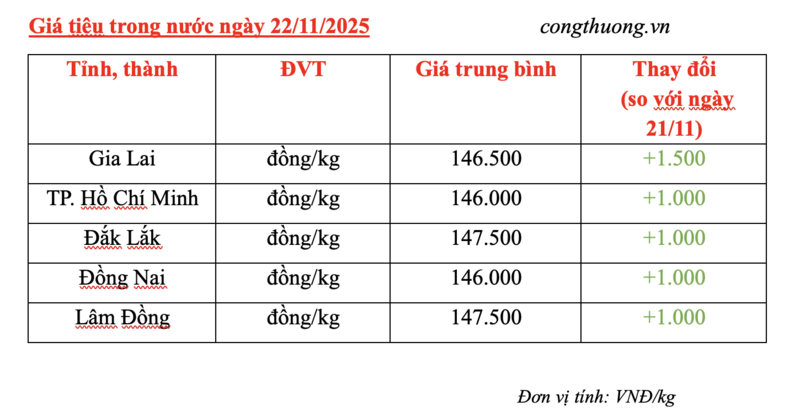

Pepper price today November 27 in the country

Domestically, pepper prices on November 27 increased sharply compared to yesterday. Specifically:

- Dak Lak pepper price increased by 1,000 VND today, trading at 150,000 VND/kg;

- Dak Nong pepper price (Lam Dong province) also reached 149,000 VND/kg;

- Gia Lai pepper price today increased by 1,000 VND, purchased at the threshold of 149,500 VND/kg;

- Dong Nai traders have traded pepper at 150,000 VND/kg, an increase of 2,000 VND;

- Pepper price in Ba Ria - Vung Tau (HCMC province) also reached 150,000 VND/kg;

- Meanwhile, traders in Binh Phuoc (Dong Nai province) traded at 149,500 VND/kg, an increase of 1,500 VND.

| Area | Price (VND/kg) | Fluctuations |

| Dak Lak | 150,000 | 1,000 |

| Dak Nong | 150,000 | 1,000 |

| Gia Lai | 149,500 | 1,000 |

| Dong Nai | 150,000 | 2,000 |

| Ba Ria - Vung Tau | 150,000 | 2,000 |

| Binh Phuoc | 149,500 | 1,500 |

Latest domestic pepper price list on November 27, 2025. Compiled by: Bang Nghiem

Today's domestic pepper price increased sharply from 1,000 - 2,000 VND, thereby pushing the price of this agricultural product to reach 150,000 VND/kg.

The US’s removal of reciprocal tariffs on many spice products from November 14, 2025, has created an important boost for the Vietnamese pepper market. At the same time, prolonged rain and floods in the Central Highlands have seriously affected agricultural production, making pepper supply even more scarce and prices have continuously increased in recent days.

Pepper price today 11/27/2025 in the country and the world latest

In Dak Lak, more than 180,000 hectares of crops were damaged, of which over 19,000 hectares of perennial crops including coffee, durian, and pepper were severely affected, causing an estimated loss of VND1,500 billion. Gia Lai and many areas of Lam Dong also recorded large losses in cultivation, livestock, and aquaculture.

In the context of impacted supply, many cooperatives in Lam Dong are promoting linkage models to stabilize production. Binh Minh Production - Trade - Service Cooperative (Dak Wil commune) is a typical unit when cooperating with processing enterprises and international organizations to build sustainable raw material areas.

Currently, the locality has nearly 2,800 hectares of pepper, with an output of about 5,500 tons; the linked area alone has reached more than 1,400 hectares. The commune government said that in the past, fragmented production made farmers vulnerable to price pressures, but the chain linkage model is helping to build brands and stabilize output.

With about 36,000 hectares of pepper, Lam Dong is aiming to develop "Clean pepper" to meet international market requirements and increase product value.

Thus, today's pepper price on November 27, 2025 in the country is trading around 147,500 - 149,000 VND/kg.

Source: https://nongnghiepmoitruong.vn/gia-tieu-hom-nay-27-11-2025-tang-manh-toi-2000-dong-d786751.html

.jpg)

Comment (0)