Supply tensions push prices up.

Pepper prices today, December 15th: A week of strong increases, reaching the 150,000 VND/kg mark again. Supply concerns due to floods and festival demand have supported positive pepper price growth.

Báo Đà Nẵng•15/12/2025

Báo Đà Nẵng•15/12/2025Today's pepper prices (December 15, 2025) in major production regions.

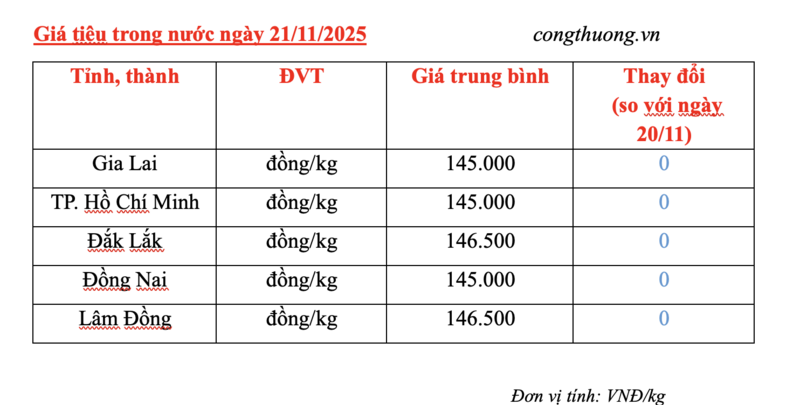

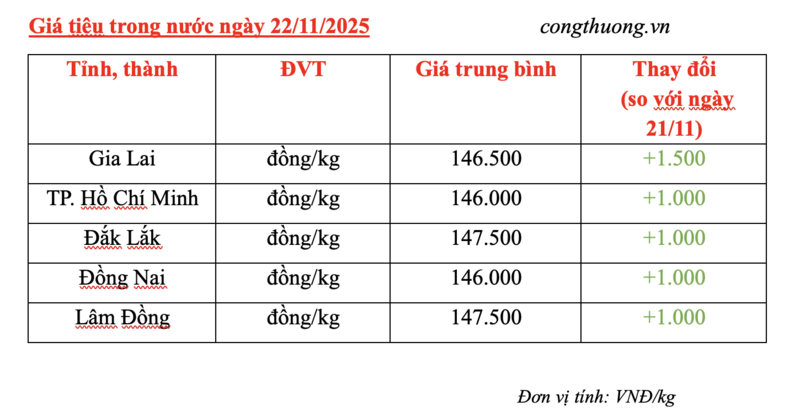

Early this morning, December 15th, domestic pepper prices remained stable compared to the same time yesterday. The purchasing levels in the Central Highlands and Southern regions are as follows:

Pepper prices in Dak Lak and Dak Nong (Lam Dong) reached a peak of 150,000 VND/kg.

The purchase price in Gia Lai, Dong Nai, and Binh Phuoc provinces is uniformly 148,500 VND/kg.

The price of pepper in Ba Ria - Vung Tau is 149,000 VND/kg.

In summary, domestic pepper prices showed an upward trend of 500 to 1,500 VND/kg during the past trading week. Prices in Ba Ria - Vung Tau saw the sharpest increase, rising by 1,500 VND/kg. The Central Highlands region saw an increase of 1,000 VND/kg, while Binh Phuoc only increased by 500 VND/kg.

With this upward trend, domestic pepper prices have reached the important mark of 150,000 VND/kg again. The price increase last week followed a week of declines of 2,000 - 3,000 VND/kg.

Analysts believe that the positive increase in pepper prices last week stemmed from several factors. Firstly, the impact of the US tariff decision. Secondly, concerns about a potential decrease in pepper supply due to prolonged and complex flooding in key growing regions of the Central Highlands pushed prices higher. Additionally, the beginning of the month coincided with preparations for the year-end festive season, boosting market demand.

Vietnam's pepper exports have already reached $1.5 billion in just 11 months. It is projected that the total export value for the whole of 2025 could exceed $1.6 billion, breaking the industry record set 10 years ago.

Vietnam's pepper industry returned to the billion-dollar mark for the first time in 2024, after many years of missed opportunities. Exports peaked at $1.42 billion in 2016, but then continuously declined, hitting a low of $666 million in 2000. Currently, the US and EU remain the two largest markets, accounting for over half of export revenue.

Despite achieving impressive export milestones, Vietnam's pepper industry still faces three core challenges. These are: strong supply and demand fluctuations, easily leading to cycles of price surges and subsequent sharp declines; increasingly stringent quality requirements from major markets such as the US, EU, and Japan; and growing competition from other major producing countries like Brazil, Indonesia, and India.

World pepper prices are stable, and international trade is undergoing many shifts.

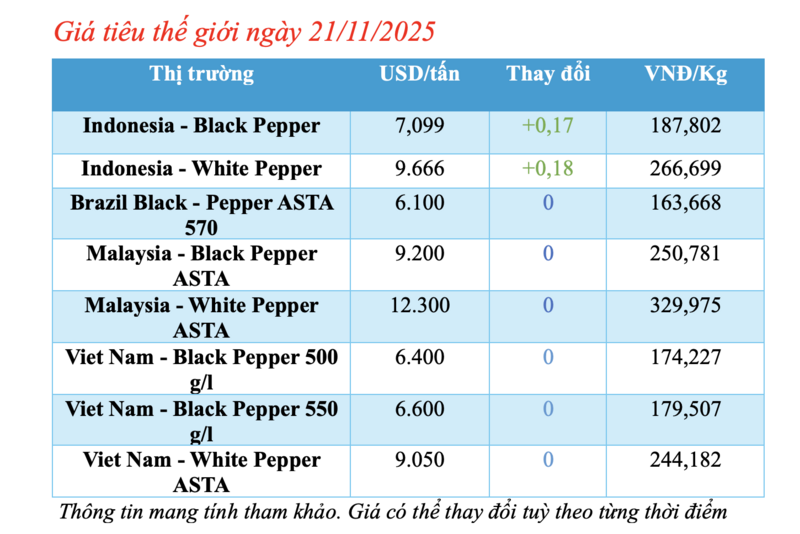

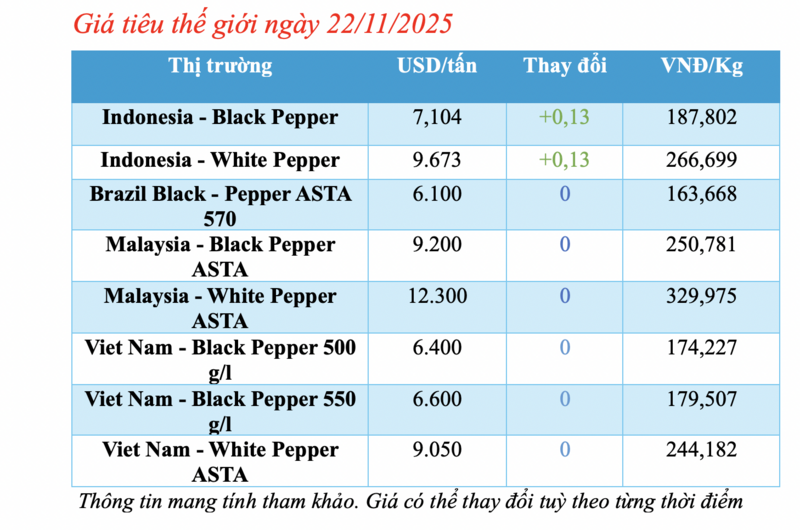

According to data from the International Pepper Association (IPC), the prices of black and white pepper in major export markets around the world remained unchanged in the most recent trading session (December 15).

Vietnamese black pepper export prices remained unchanged at US$6,500 – US$6,700/ton for 500 g/l and 550 g/l grades. Indonesian black pepper (Lampung) prices were stable at US$6,996/ton. Brazilian ASTA 570 black pepper reached US$6,075/ton. Malaysian black pepper was priced at US$9,000/ton.

White pepper prices also remained stable in various markets: Indonesian Muntok white pepper prices stayed unchanged at US$9,645/ton. Malaysian white pepper prices reached US$12,000/ton. Vietnamese white pepper prices reached US$9,250/ton.

According to the Import-Export Department (Ministry of Industry and Trade), pepper imports into the Netherlands in August reached 728 tons, a 45% decrease compared to the previous month. This decline was mainly due to a 38.9% decrease in imports from Vietnam, the largest supplier.

Overall, in the first eight months of 2025, the Netherlands imported 8,755 tons of pepper, a 23% decrease in volume compared to the same period in 2024. However, the import value increased by 13.4% due to rising pepper prices.

Vietnam is the largest supplier of pepper in the Netherlands, accounting for 56.9% of the market share in the first eight months of 2025.

The average import price of pepper into the Netherlands market in the first eight months of 2025 reached US$7,751 per ton, an increase of 47.2% compared to the same period in 2024.

Although imports from Vietnam decreased by 30.2% in volume during the first eight months of the year, the import value increased. The average export price of Vietnamese pepper to the Netherlands reached US$7,989 per ton, higher than Brazil (US$5,881 per ton) but lower than Indonesia (US$8,151 per ton).

Brazil's market share also decreased from 15.5% to 11.7%. Other markets such as Indonesia, India, China, and Germany all saw significant increases in market share.

Source: https://baodanang.vn/gia-tieu-hom-nay-15-12-2025-cang-thang-nguon-cung-day-gia-tang-3314936.html

.jpg)

Comment (0)