US reduces purchases, but China and UAE 'race' to skyrocket, pepper exports remain stable

Pepper prices today, September 21, 2025, are stable, the US reduced imports by 15.4%, but China increased by 47%, UAE increased by 31.6%. Vietnam's pepper exports remain stable, reaching 10,544 tons.

Báo Đà Nẵng•20/09/2025

Báo Đà Nẵng•20/09/2025Pepper price today September 21, 2025 in the domestic market

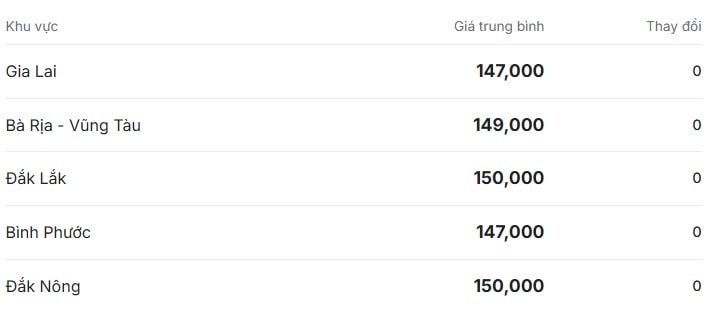

Pepper prices today (September 20, 2025) in the Central Highlands and Southeast continue to remain stable, fluctuating from 147,000 - 150,000 VND/kg.

Dak Lak and Dak Nong are currently the two provinces with the highest prices, reaching 150,000 VND/kg. Next is Ba Ria - Vung Tau with 149,000 VND/kg.

Meanwhile, pepper prices in Gia Lai and Binh Phuoc today are at 147,000 VND/kg.

According to the price list, all provinces have not recorded any changes compared to yesterday. This stability is considered good news for farmers.

Compared to the previous day, pepper prices in all provinces remained unchanged, reflecting the current state of the domestic market, with abundant supply from the harvest and stable export demand. This stability is considered a positive signal for farmers, helping them avoid the risk of sudden price fluctuations. However, domestic pepper prices are still affected by export prices and global supply, leading to a situation that shows no signs of a sharp increase in the short term.

According to experts and the Vietnam Pepper Association (VPSA), the pepper market is currently in a tug-of-war, with prices unlikely to increase sharply in the short term due to the lack of a real breakthrough in international demand. However, from late 2025 to early 2026, pepper prices are expected to increase thanks to a 10-15% decrease in global supply, low inventories, while demand is stable in major markets such as the US, Europe, China and India. As the world's number one exporter (accounting for over 55% of the global market share), Vietnam is expected to benefit greatly.

If the strategy of market diversification, improving processing quality and sustainable production is maintained, Vietnam's pepper price can reach 240,000 - 250,000 VND/kg. To achieve this, the industry needs to reduce dependence on traditional markets and focus more on quality, helping to strengthen its competitive position in the face of fluctuations in global supply and demand.

Pepper price today September 21 in the world market

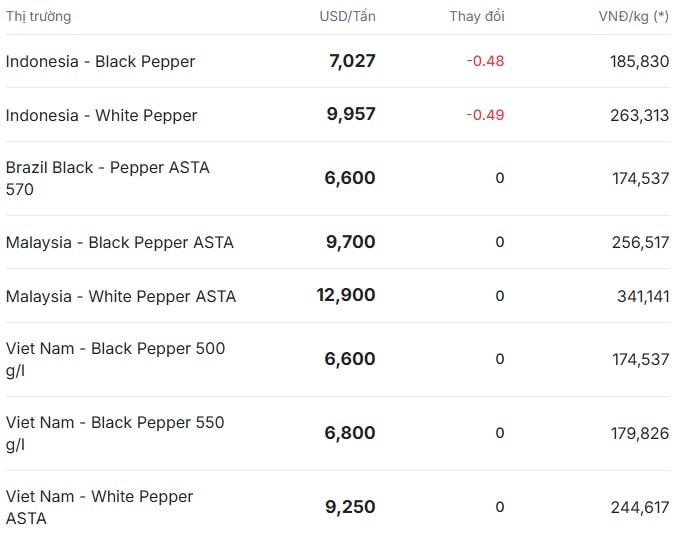

At the end of the most recent trading session, the world pepper market witnessed stability in most commodities.

The price of Brazilian black pepper ASTA 570 remained stable at USD 6,600/ton. Similarly, the export price of Vietnamese black pepper remained unchanged, with the 500g/l grade reaching USD 6,600/ton and the 550g/l grade reaching USD 6,800/ton.

Malaysian ASTA black pepper price also remained stable at USD 9,700/ton.

On the contrary, Indonesian pepper prices have been adjusted. Specifically, Indonesian black pepper decreased by 0.48% to 7,027 USD/ton. At the same time, Indonesian Muntok white pepper also decreased by 0.49% to 9,957 USD/ton.

Meanwhile, Vietnamese white pepper remained unchanged at 9,250 USD/ton. Malaysian ASTA white pepper continued to move sideways at 12,900 USD/ton.

In the international market, pepper prices today (September 20, 2025) recorded stability in most commodities. The price of Brazilian black pepper ASTA 570 remained at 6,600 USD/ton, Vietnamese black pepper remained at 6,600 USD/ton (500 g/l) and 6,800 USD/ton (550 g/l), while Malaysian black pepper was stable at 9,700 USD/ton.

However, Indonesian Lampung black pepper and Muntok white pepper decreased slightly, reaching USD 7,027/ton and USD 9,957/ton, respectively. Vietnamese white pepper remained unchanged at USD 9,250/ton, while Malaysian pepper remained at USD 12,900/ton.

Regarding trade activities, Vietnam's pepper exports in the first 16 days of September 2025 reached 10,544 tons, with a turnover of 69.3 million USD, only slightly down compared to 10,830 tons (71.8 million USD) in the first 17 days of August. The US remained the largest market with 1,865 tons, although down 15.4%, while China increased sharply by 47% to 1,416 tons and the UAE increased by 31.6% to 1,034 tons.

This reflects market diversification, with Asia and the Middle East becoming increasingly important. In contrast, imports fell sharply to 998 tonnes (US$6.2 million), mainly from Cambodia, Brazil and Indonesia, as Vietnamese businesses prioritized domestic sources.

Source: https://baodanang.vn/gia-tieu-hom-nay-21-9-2025-my-giam-mua-nhung-trung-quoc-va-uae-dua-nhau-tang-vot-xuat-khau-tieu-van-vung-vang-3303266.html