Wednesday, November 26, 2025

Pepper price today November 26, 2025

Pepper price today November 26, 2025 increased steadily both domestically and internationally

Pepper price today November 26, 2025 maintained a slight upward trend, domestically reaching a new level while the world increased sharply in Indonesia.

Domestic pepper prices remain high

On the morning of November 26, domestic pepper prices fluctuated from 148,000 to 149,000 VND/kg. Gia Lai increased by 200 VND to 148,500 VND/kg, while Dong Nai increased by 500 VND to the same level of 148,500 VND/kg.

Dak Lak and Dak Nong continue to be the two regions with the highest prices, maintaining the level of 149,000 VND/kg. In Binh Phuoc and Ho Chi Minh City, the price is stable at 148,000 VND/kg.

Domestic supply is quite limited due to prolonged floods in the Central Highlands, creating a risk of affecting output. Exporting enterprises have increased purchases to offset the risk of goods supply, while major markets such as the US, EU and China continue to maintain strong demand.

With the current supply and demand, pepper prices are forecast to hardly fall below 148,000 VND/kg in the near future. If the unfavorable weather continues, the market may even establish a higher price level.

Prolonged rainy and flooded weather in the Central Highlands along with stable purchasing power from international markets is creating a new price foundation for Vietnamese pepper in the final period of the year.

World pepper prices increase sharply in Indonesia

According to the International Pepper Community (IPC), the international market recorded a clear increase on the morning of November 26. In Indonesia, Lampung black pepper increased to 7,126 USD/ton, while Muntok white pepper reached 9,703 USD/ton.

Malaysia kept prices stable at USD 9,200/ton for black pepper and USD 12,300/ton for white pepper, respectively. Brazil maintained USD 6,100/ton, unchanged from the previous session.

Vietnam currently maintains stable export prices: black pepper 500g/l at 6,400 USD/ton, 550g/l at 6,600 USD/ton, and white pepper remains at 9,050 USD/ton.

Compared to the same period last year, Vietnam's pepper prices have increased in both domestic and international markets. Black pepper 500g/l has increased from 6,200 USD/ton to 6,400 USD/ton, showing a clear recovery thanks to strong purchasing power from the EU, the US and China.

A positive signal from the US market, since November 14, Washington has officially removed reciprocal tariffs on many agricultural products from Vietnam, including pepper. Reducing trade barriers helps Vietnamese pepper improve its competitive advantage, especially in the context of limited global supply.

Source: https://baodanang.vn/gia-tieu-hom-nay-26-11-2025-tang-on-dinh-ca-trong-nuoc-va-the-gioi-3311443.html

Friday, November 21, 2025

Pepper price today November 21, 2025: Highest 146,500 VND/kg

Pepper price today November 21: Domestic pepper price remained unchanged, trading from 144,500 - 146,500 VND/kg. Meanwhile, the Indonesian market increased slightly.

Báo Công thương•20/11/2025

Báo Công thương•20/11/2025World pepper price November 21: Slight increase in Indonesia

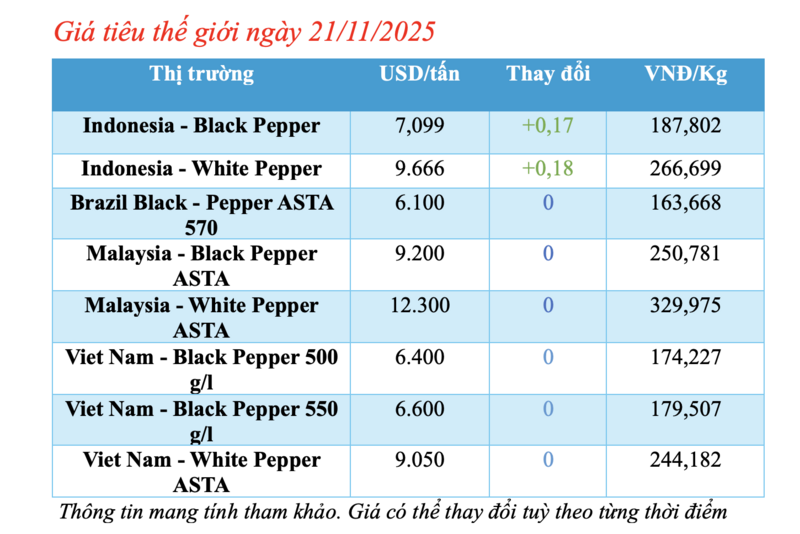

Update on world pepper prices from the International Pepper Community (IPC) at 4:30 a.m. on November 21, 2025, today's pepper exports recorded fluctuations in the Indonesian market. All markets had stable prices compared to yesterday's trading session.

Specifically, the price of Indonesian Lampung black pepper was traded at 7,099 USD/ton, up slightly 0.17% compared to the previous session.

Similarly, the price of Muntok white pepper of this country also increased slightly by 0.18% compared to yesterday, currently trading at 9,666 USD/ton.

In Malaysia, the price of ASTA black pepper is currently stable at 9,200 USD/ton. The price of ASTA white pepper in this market today reached 12,300 USD/ton, unchanged from yesterday.

In Brazil, pepper prices remained around $6,100/ton, unchanged from yesterday.

Prices of all types of Vietnamese pepper remain unchanged, of which, the price of Vietnamese black pepper 500 gr/l remains unchanged at 6,400 USD/ton; the price of 550 gr/l remains unchanged at 6,600 USD/ton.

Similarly, Vietnam's white pepper price remained unchanged at USD 9,050/ton.

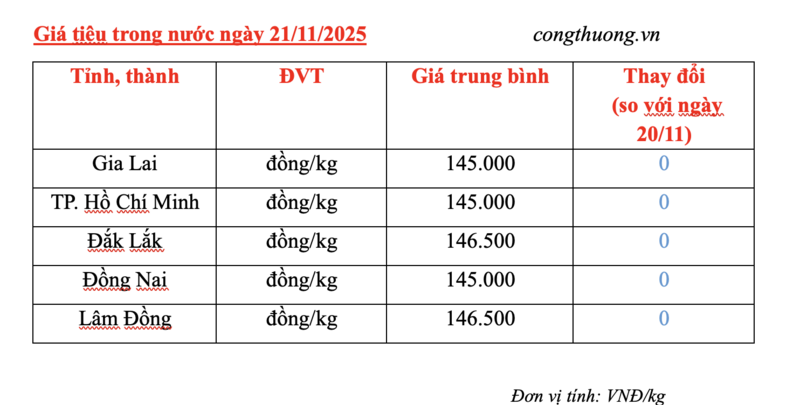

Domestic pepper price today November 21: Highest at 146,500 VND/kg

Meanwhile, domestic pepper prices today (November 21) remained unchanged compared to yesterday, ranging from 144,500 - 146,500 VND/kg.

Specifically, in Gia Lai today, pepper is traded at 145,000 VND/kg, unchanged from yesterday.

Similarly, pepper prices in Ho Chi Minh City and Dong Nai also remained stable, currently trading at 145,000 VND/kg.

Meanwhile, traders in Dak Lak and Lam Dong traded pepper at 146,500 VND/kg, unchanged from yesterday. These are also the two localities with the highest pepper prices in the country today.

Source: https://congthuong.vn/gia-tieu-hom-nay-21-11-2025-cao-nhat-146-500-dong-kg-431412.html

Pepper price today November 22, 2025: Strong increase

Pepper price today November 22: Domestic pepper price increased sharply from 1,000 - 1,500 VND/kg. Currently, domestic pepper price fluctuates from 146,000 - 147,500 VND/kg.

Báo Công thương•21/11/2025

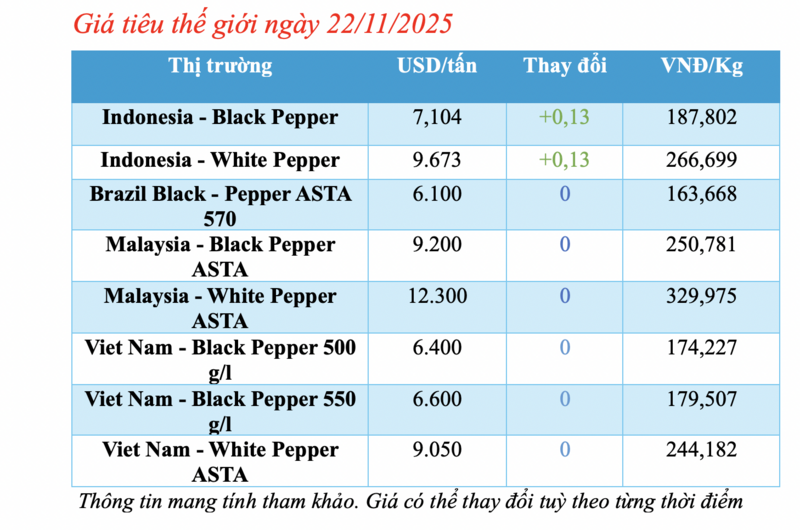

Báo Công thương•21/11/2025World pepper price November 22: Continued slight increase in Indonesia

Update on world pepper prices from the International Pepper Community (IPC) at 4:30 a.m. on November 21, 2025, today's pepper exports recorded fluctuations in the Indonesian market. All markets had stable prices compared to yesterday's trading session.

Specifically, the price of Indonesian Lampung black pepper was traded at 7,104 USD/ton, up slightly 0.13% compared to the previous session.

Similarly, the price of Muntok white pepper of this country also increased slightly by 0.13% compared to yesterday, currently trading at 9,673 USD/ton.

In Malaysia, the price of ASTA black pepper is currently stable at 9,200 USD/ton. The price of ASTA white pepper in this market today reached 12,300 USD/ton, unchanged from yesterday.

In Brazil, pepper prices remained around $6,100/ton, unchanged from yesterday.

Prices of all types of Vietnamese pepper remain unchanged, of which, the price of Vietnamese black pepper 500 gr/l remains unchanged at 6,400 USD/ton; the price of 550 gr/l remains unchanged at 6,600 USD/ton.

Similarly, Vietnam's white pepper price remained unchanged at USD 9,050/ton.

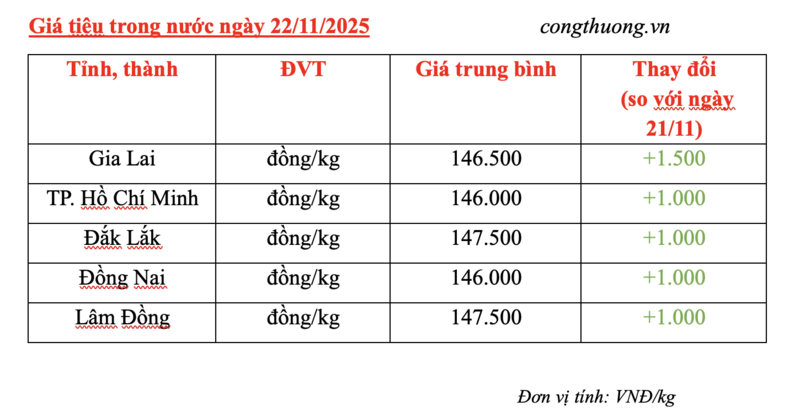

Domestic pepper price today November 22: Strong increase

Meanwhile, domestic pepper prices today (November 22) increased sharply by 1,000 - 1,500 VND/kg compared to yesterday, fluctuating from 146,000 - 147,500 VND/kg.

Specifically, in Gia Lai today, pepper is traded at 146,500 VND/kg, a sharp increase of 1,500 VND/kg compared to yesterday.

Similarly, pepper prices in Ho Chi Minh City and Dong Nai also increased sharply by VND1,000/kg, currently trading at VND146,000/kg.

Meanwhile, traders in Dak Lak and Lam Dong traded pepper at 147,500 VND/kg, a sharp increase of 1,000 VND/kg compared to yesterday. These are also the two localities with the highest pepper prices in the country today.

Source: https://congthuong.vn/gia-tieu-hom-nay-22-11-2025-bat-tang-manh-431579.html

Friday, November 07, 2025

𝐕𝐢𝐞𝐭𝐧𝐚𝐦 𝐏𝐞𝐩𝐩𝐞𝐫 𝐈𝐦𝐩𝐨𝐫𝐭 & 𝐄𝐱𝐩𝐨𝐫𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰 (𝐉𝐚𝐧𝐮𝐚𝐫𝐲 – 𝐎𝐜𝐭𝐨𝐛𝐞𝐫 𝟐𝟎𝟐𝟓)

.

1. EXPORT

𝐴𝑠 𝑜𝑓 𝑡ℎ𝑒 𝑒𝑛𝑑 𝑜𝑓 𝑂𝑐𝑡𝑜𝑏𝑒𝑟 2025, 𝑉𝑖𝑒𝑡𝑛𝑎𝑚

𝑒𝑥𝑝𝑜𝑟𝑡𝑒𝑑 𝑎 𝑡𝑜𝑡𝑎𝑙 𝑜𝑓 𝟐𝟎𝟔,𝟒𝟐𝟕 𝐭𝐨𝐧𝐬 𝑜𝑓

𝑝𝑒𝑝𝑝𝑒𝑟 𝑜𝑓 𝑎𝑙𝑙 𝑘𝑖𝑛𝑑𝑠, 𝑖𝑛𝑐𝑙𝑢𝑑𝑖𝑛𝑔 176,577 𝑡𝑜𝑛𝑠

𝑜𝑓 𝑏𝑙𝑎𝑐𝑘 𝑝𝑒𝑝𝑝𝑒𝑟 𝑎𝑛𝑑 29,850 𝑡𝑜𝑛𝑠 𝑜𝑓 𝑤ℎ𝑖𝑡𝑒

𝑝𝑒𝑝𝑝𝑒𝑟.

𝑇𝑜𝑡𝑎𝑙

𝑒𝑥𝑝𝑜𝑟𝑡 𝑡𝑢𝑟𝑛𝑜𝑣𝑒𝑟 𝑟𝑒𝑎𝑐ℎ𝑒𝑑 𝑈𝑆𝐷 1.3937

𝑏𝑖𝑙𝑙𝑖𝑜𝑛, 𝑤𝑖𝑡ℎ 𝑏𝑙𝑎𝑐𝑘 𝑝𝑒𝑝𝑝𝑒𝑟 𝑐𝑜𝑛𝑡𝑟𝑖𝑏𝑢𝑡𝑖𝑛𝑔

𝑈𝑆𝐷 1.1456 𝑏𝑖𝑙𝑙𝑖𝑜𝑛 𝑎𝑛𝑑 𝑤ℎ𝑖𝑡𝑒 𝑝𝑒𝑝𝑝𝑒𝑟 𝑈𝑆𝐷 244.0

𝑚𝑖𝑙𝑙𝑖𝑜𝑛.

𝐶𝑜𝑚𝑝𝑎𝑟𝑒𝑑 𝑡𝑜 𝑡ℎ𝑒 𝑠𝑎𝑚𝑒

𝑝𝑒𝑟𝑖𝑜𝑑 𝑖𝑛 2024, 𝑒𝑥𝑝𝑜𝑟𝑡 𝑣𝑜𝑙𝑢𝑚𝑒 𝑑𝑒𝑐𝑟𝑒𝑎𝑠𝑒𝑑

𝑏𝑦 5.9%, 𝑏𝑢𝑡 𝑒𝑥𝑝𝑜𝑟𝑡 𝑣𝑎𝑙𝑢𝑒 𝑖𝑛𝑐𝑟𝑒𝑎𝑠𝑒𝑑 𝑏𝑦 25.4%.

𝑇ℎ𝑒

𝑎𝑣𝑒𝑟𝑎𝑔𝑒 𝑒𝑥𝑝𝑜𝑟𝑡 𝑝𝑟𝑖𝑐𝑒 𝑜𝑣𝑒𝑟 10 𝑚𝑜𝑛𝑡ℎ𝑠 𝑤𝑎𝑠

𝑈𝑆𝐷 6,628/𝑡𝑜𝑛 𝑓𝑜𝑟 𝑏𝑙𝑎𝑐𝑘 𝑝𝑒𝑝𝑝𝑒𝑟 𝑎𝑛𝑑 𝑈𝑆𝐷

8,683/𝑡𝑜𝑛 𝑓𝑜𝑟 𝑤ℎ𝑖𝑡𝑒 𝑝𝑒𝑝𝑝𝑒𝑟, 𝑢𝑝 36.6% 𝑎𝑛𝑑 34.4%

𝑟𝑒𝑠𝑝𝑒𝑐𝑡𝑖𝑣𝑒𝑙𝑦 𝑦𝑒𝑎𝑟-𝑜𝑛-𝑦𝑒𝑎𝑟.

Top export markets:

- USA: 44,262 tons (21.4%), down 29.4% YoY but up 3.9% vs 2023.

- U.A.E: 17,304 tons (8.4%), up 18.8%.

- China: 16,567 tons (8.0%), up 79.1%.

- India: 11,370 tons (5.5%), up 20.6%.

- Germany: 10,198 tons (4.9%), down 25.8%.

𝑂𝑡ℎ𝑒𝑟

𝑚𝑎𝑟𝑘𝑒𝑡𝑠 𝑤𝑖𝑡ℎ 𝑛𝑜𝑡𝑎𝑏𝑙𝑒 𝑔𝑟𝑜𝑤𝑡ℎ 𝑖𝑛𝑐𝑙𝑢𝑑𝑒

𝑇ℎ𝑎𝑖𝑙𝑎𝑛𝑑 (+29.1%), 𝑃𝑜𝑙𝑎𝑛𝑑 (+23.7%), 𝑇𝑢𝑟𝑘𝑒𝑦 (+10.3%),

𝐸𝑔𝑦𝑝𝑡 (+4.2%), 𝑎𝑛𝑑 𝑆𝑜𝑢𝑡ℎ 𝐾𝑜𝑟𝑒𝑎 (+2.0%).

2. IMPORT

𝐹𝑟𝑜𝑚 𝐽𝑎𝑛𝑢𝑎𝑟𝑦 1 𝑡𝑜 𝑂𝑐𝑡𝑜𝑏𝑒𝑟 31, 2025, 𝑉𝑖𝑒𝑡𝑛𝑎𝑚

𝑖𝑚𝑝𝑜𝑟𝑡𝑒𝑑 𝟑𝟕,𝟕𝟖𝟑 𝐭𝐨𝐧𝐬 𝑜𝑓 𝑝𝑒𝑝𝑝𝑒𝑟, 𝑤𝑜𝑟𝑡ℎ

𝑈𝑆𝐷 236.9 𝑚𝑖𝑙𝑙𝑖𝑜𝑛, 𝑖𝑛𝑐𝑙𝑢𝑑𝑖𝑛𝑔 32,226 𝑡𝑜𝑛𝑠 𝑜𝑓

𝑏𝑙𝑎𝑐𝑘 𝑝𝑒𝑝𝑝𝑒𝑟 𝑎𝑛𝑑 5,557 𝑡𝑜𝑛𝑠 𝑜𝑓 𝑤ℎ𝑖𝑡𝑒

𝑝𝑒𝑝𝑝𝑒𝑟.

𝐶𝑜𝑚𝑝𝑎𝑟𝑒𝑑

𝑡𝑜 𝑡ℎ𝑒 𝑠𝑎𝑚𝑒 𝑝𝑒𝑟𝑖𝑜𝑑 𝑙𝑎𝑠𝑡 𝑦𝑒𝑎𝑟, 𝑖𝑚𝑝𝑜𝑟𝑡

𝑣𝑜𝑙𝑢𝑚𝑒 𝑟𝑜𝑠𝑒 𝑏𝑦 25.3% 𝑎𝑛𝑑 𝑣𝑎𝑙𝑢𝑒 𝑖𝑛𝑐𝑟𝑒𝑎𝑠𝑒𝑑

𝑏𝑦 65.6%. 𝑉𝑒𝑟𝑠𝑢𝑠 2023, 𝑖𝑚𝑝𝑜𝑟𝑡 𝑣𝑜𝑙𝑢𝑚𝑒 𝑠𝑢𝑟𝑔𝑒𝑑

67.9%.

Main import countries:

- Brazil: 18,481 tons (+105.0%), accounting for 48.9%.

- Cambodia: 9,705 tons (+45%), accounting for 25.7%.

- Indonesia: 6,946 tons (–32.5%), accounting for 18.4%.

Heavy rains are delaying the maturity of peppercorns in Brazil

Rising demand boosts cardamom sector

Rising demand boosts cardamom sector as harvest gains pace in Idukki

Prices seen range bound on firm export demand as output dips in Guatemala

By V Sajeev Kumar

Surging demand coupled with increased arrivals to auctions has brought cheers to the cardamom sector, even as the picking season in Idukki, a key producing region, goes on in full swing.

Though the incessant rains from May to October dented production by around 15 to 20 per cent, the rise in area and better investments has led to increased arrivals in this season. Given such a situation, the crop could be between 32,000 to 34,000 tonne in this season, S.B.Prabhakar, a cardamom planter said. The North East monsoon is expected to last till December which should contribute to a reasonable late crop, he added.

The prices are

expected to remain in the range of around ₹2,400 to ₹2,700 per kg for

the next 3 to 4 months. Then, the spring showers will dictate movement

of prices. However there is no chance for a major drop in prices anytime

soon, he said.

Rising demand boosts cardamom sector as harvest gains pace in Idukki

Prices seen range bound on firm export demand as output dips in Guatemala

By V Sajeev Kumar

Surging demand coupled with increased arrivals to auctions has brought cheers to the cardamom sector, even as the picking season in Idukki, a key producing region, goes on in full swing.

Though the incessant rains from May to October dented production by around 15 to 20 per cent, the rise in area and better investments has led to increased arrivals in this season. Given such a situation, the crop could be between 32,000 to 34,000 tonne in this season, S.B.Prabhakar, a cardamom planter said. The North East monsoon is expected to last till December which should contribute to a reasonable late crop, he added.

The prices are expected to remain in the range of around ₹2,400 to ₹2,700 per kg for the next 3 to 4 months. Then, the spring showers will dictate movement of prices. However there is no chance for a major drop in prices anytime soon, he said.

The Guatemala production is expected to be only around 16,000 to 20,000 tonne against their normal production of around 45,000 tonne as plants slowly recover from last year’s devastating El Nino drought.

Thus, India has overtaken Guatemala to become the world’s largest producer of cardamom in the last 2 seasons since 1981-82 after a gap of 44 years. This shortfall in production over the past two seasons has created a global deficit and India should be able to export more cardamom in the coming months.

Joseph Sebastain of EcoSpice said there has been a record inflow of cardamom into daily auctions accompanied by a robust export and domestic demand. However, with strong global demand and Guatemala’s limited recovery, India’s cardamom market is expected to remain firm and well-supported in the near term. Although Guatemala’s total cultivation area is about 40 per cent larger than that of India, its productivity remains lower due to the lack of scientific farming practices and professional crop management.

Many growers in the domestic market are now capable of holding back stock, closely observing the global market trends, and releasing produce strategically. Instead of distress sales, most farmers are selling immediately after harvest at favourable prices, ensuring steady cash flow while benefiting from high demand, he added.

According to SKM Dhanavandan, an exporter in Bodinayakkanur, the sector is gearing up for Ramadan 2026 booking and the Gulfood 2026 in January. Global demand, especially from the Gulf, is highly concentrated on grades like 6-7 mm, 7-8 mm and 8mm (superior grade). However, the quantity of small size cardamom, low-value capsules is limited right now due to the nature of the current harvest/season. This scarcity of export-preferred sizes presents a major supply-demand paradox, he said.

To capitalise on this key window and secure large-volume deals, he said a revision and strategic lowering of the average export price ($28-30 per kg) for premium grades is necessary to make Indian cardamom globally competitive.

Published on November 3, 2025

.jpg)

Comment (0)