By JACK WONG

KUCHING: Domestic pepper prices have weakened considerably this year, after 2021’s powerful rally as a result of the spice’s global oversupply.

Other key factors contributing to the pull-back in prices include the Russia-Ukraine war, inflationary pressures and the strong US dollar.

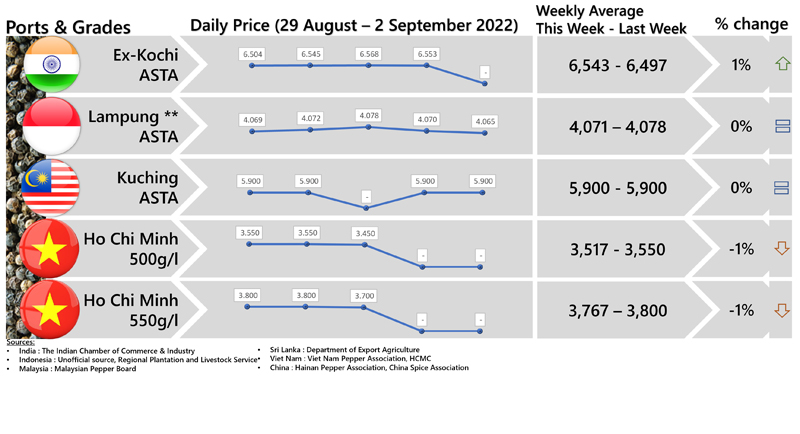

Kuching Grade 1 black pepper slipped to RM13,750 per tonne on Aug 12 from RM17,330 per tonne in December 2021, down by RM3,580 per tonne or more than 20%.

Likewise, Kuching Grade 1 white pepper fell to RM23,850 per tonne from RM26,450 per tonne or by RM2,600 or about 10% during the same period, according to Malaysian Pepper Board’s (MPB) daily published prices.

In 2021, both black and white pepper prices posted impressive gains, soaring by about 90% from RM9,050 per tonne and 65% from RM16,000 per tonne respectively recorded in 2020.

Last year, both the black and white pepper prices climbed to their highest levels in three years since 2018, but were still far way off from their all-time highs of RM30,000 per tonne and RM50,000 per tonne respectively, in 2015.

International Pepper Community (IPC) executive director Firna Azura Ekaputri Marzuki said the current pepper market continues to be bearish, as the world grapples with demand erosion this year due to “deficit changing to surplus” inventory.

Other factors are depreciating currencies because of the strong dollar, inflation and low consumer appetite.

“China has returned to the pepper market but it may not be enough to cheer markets as Brazil and Indonesia are entering harvest season for 2022,” she added in her presentation on “Globalisation and World Pepper Industry 2021/2022” at Universiti Malaysia Sarawak (Unimas) late last month.

Sarawak’s established pepper exporter Nguong Aik (Kuching) Sdn Bhd director William S C Yii said as China, a major pepper consuming country, has not fully re-opened its international borders due to its Covid zero policy, it has resulted in a cut down in imports from major producing and supplying countries like Vietnam.

“Now China is very short of pepper because of a lot of restrictions (in imports). If Vietnam exporters cannot sell to China, they have to sell to other markets, like the United States and Europe and this has affected pepper prices,” Yii told StarBiz.

Vietnam, the world’s number one pepper producer and exporter, was estimated to have exported 261,000 tonnes valued at US$938mil (RM4.17bil) in 2021. This was down 8.5% in volume but up 42% in value from 2020, thanks to strong export prices.

Year-on-year, Vietnam’s average export price of pepper products jumped 53.5% to reach US$3,757 (RM16,697) per tonne in 2021.

Yii said the Russia-Ukraine war, which broke out in February 2022, has affected demand and pepper shipments to the two countries which imported a combined 7,000 tonnes a year previously.

He said the new Indonesian pepper crop, which will come into the market from next month, might be bigger in quantity than that of 2021. This may put pressure on pepper prices as Indonesia is the world’s second largest pepper producer.

The strong US dollar, he added, is another reason for the weak pepper prices as this dampened consumption of the spice.

Late last year, Yii was bullish and had predicted pepper prices to extend their rallies by another 30% in 2022. But the unexpected turn of events as mentioned has largely changed his views on the market outlook.

“The current pepper market is very inactive and extremely quiet. Though cargo containers are now available and the global shipping freight rates have come down from (their historical peaks) last year, these are still high compared to the pre-Covid-19 period,” he said.

Frina expects the global pepper market to stabilise and prices to firm up in November and December.

Concurring with her, Yii said it is normally in the third quarter and towards the end of the year when the global pepper market is more active, with prices on the uptrend.

“If China fully opens up its international borders by then, this may push up pepper prices by 10% to 20%, from current levels. But any price spike will attract sellers,” Yii said.

On Sarawak’s new pepper crop, he said the harvesting season was just over and that it had been a “failure crop”. Yii estimates this year’s small crop production to be 10% to 20% lower, compared to the past two years.

According to MPB, Malaysia produced 31,600 tonnes of pepper in 2021 (2020: 30,804 tonnes), with Sarawak contributing nearly 98% of the country’s total output. In 2021, Malaysia, which ranks fourth among the top five IPC member producers, exported 7,407 tonnes of pepper worth RM153.7mil.

Yii said pepper farmers are hit by soaring imported fertiliser prices, which have doubled from that of 2021.

Fertiliser made up about 70% of farm inputs.

Inadequate fertilising of pepper vines will affect yields.

At current weak prices, Yii said the better-to-do pepper farmers and rich dealers are holding onto their inventories and hoping to sell at higher prices.

By JACK WONG

TAGS / KEYWORDS:

Pepper , Prices , Down ,

https://www.thestar.com.my/business/business-news/2022/08/15/pepper-market-slows-down

REMINDER

PINK PEPPER HARVEST IS IN FULL SWING IN BRAZIL

CALL FOR A GOOD QUALITY OFFER

manager@peppertrade.com.br